What We Do

Swap Monitoring, Valuation, GASB 53/72

Sustainable Finance Consulting

Swap Monitoring, Valuation, GASB 53/72

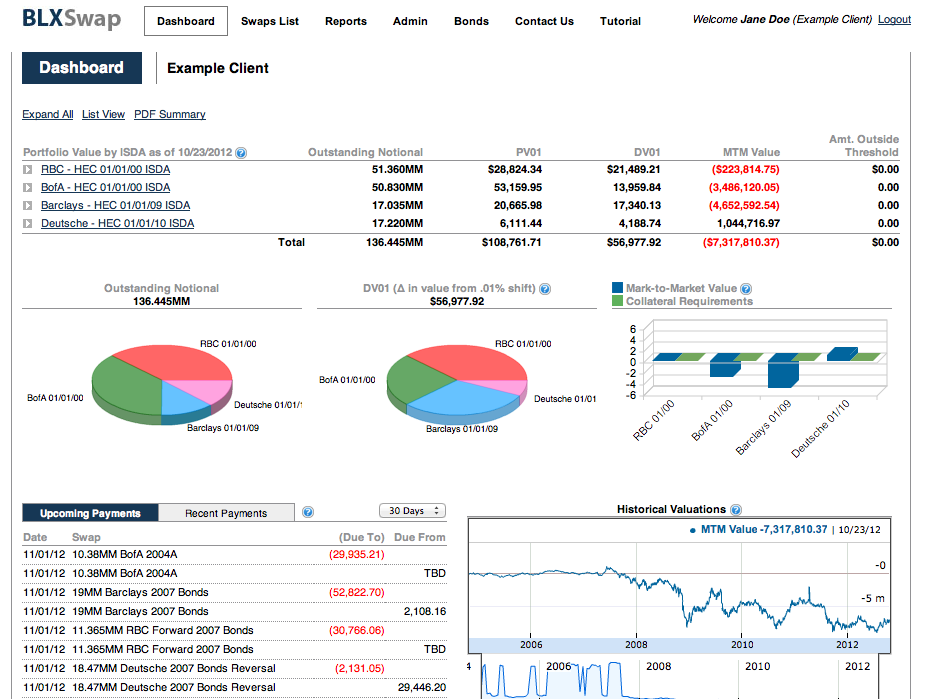

Swaps are not “set it and forget it” transactions. The interest rate swaps (and other derivatives) used by tax-exempt issuers are often complex, tailored, and long-term. They’re also an important part of an issuers overall hedging or debt portfolio. Now more than ever, issuers are concerned with mark-to-market values, collateral posting, and counterparty credit exposure on an ongoing basis. In addition, the accounting, and compliance responsibilities of issuers have increased significantly with the advent of new accounting standards such as GASB 53, FAS 133/815, and FAS 157/820.

BLX created BLXSwap to help our clients monitor their swap transactions and comply with applicable accounting requirements. BLXSwap provides a centralized platform where clients may access key information regarding their swap transactions at any time, from any internet connected computer. Combined with our hands-on approach to each engagement, our clients receive a convenient service and great value.

This screenshot is for illustrative purposes only.

- Daily valuations of swap transactions

- All valuations done on a per-transaction, per-ISDA, and portfolio basis

- Current collateral posting requirements

- Portfolio statistics including average life, on-market rate, DV01, and PV01

- Upcoming and historical payment schedule

- Historical valuation and related data for the portfolio

- Comprehensive alerts via email based on customized valuation thresholds, collateral requirements, and/or counterparty ratings

For more information about BLXSwap, please contact:

Guangyu Shi

978 448 4151

[email protected]