What We Do

Debt Advisory

ESG / Sustainable Finance Consulting

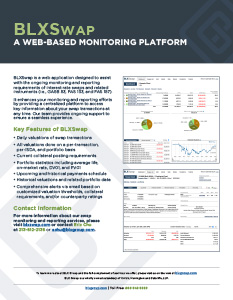

Swap Monitoring, Valuation, GASB 53/72

Structured Investment Product Bidding

Municipal Liquidity Facility Program (MLF)

BLX is a registered municipal advisor providing a full range of independent financial advisory services to tax-exempt entities, including both the government and non-profit 501(c)(3) sectors.

Securing tax-exempt financing is a challenging and continually changing process for borrowers who seek to finance new projects or refinance existing debt. Capital planning and transaction management demand a solid understanding of complex technical and market issues. As an experienced financial advisor, BLX provides an independent perspective on the choices and decisions which tax-exempt borrowers make as they prepare for a bond issue. On advisory engagements, we operate exclusively as the borrower’s independent representative, and our obligation is to provide information and advice which services our client’s best interest in the planning and execution of a bond transaction.

DEBT ADVISORY SERVICES OFFERED BY BLX

- Provide debt capacity studies and capital planning analysis

- Evaluate financing options and alternative debt structures based upon credit and market conditions and associated risks and costs

- Assist in selecting a method of sale from options including negotiated bond sales, or bank loans

- Assist in requesting, evaluating, and selecting proposals for capital financing packages from qualified firms

- Assist in the review and preparation of bond financing and disclosure documents

- Assist rating agency and credit presentations

- Negotiate and reviewing terms and conditions of credit enhancement products

- Provide bond pricing advisory services to determine the fairness of the final terms and interest rates proposed by underwriters

BLX is dedicated to delivering the best solution to the most complex financial structures.

For more information, please contact:

Glenn Casterline

213-612-2229

gcasterline@blxgroup.com